Carbon tax gradient icon.Tax levied on carbon goods and services.Economically profitable. Universal basic income.Isolated vector illustration.Suitable to banners,mobile apps and presentation Stock-vektor | Adobe Stock

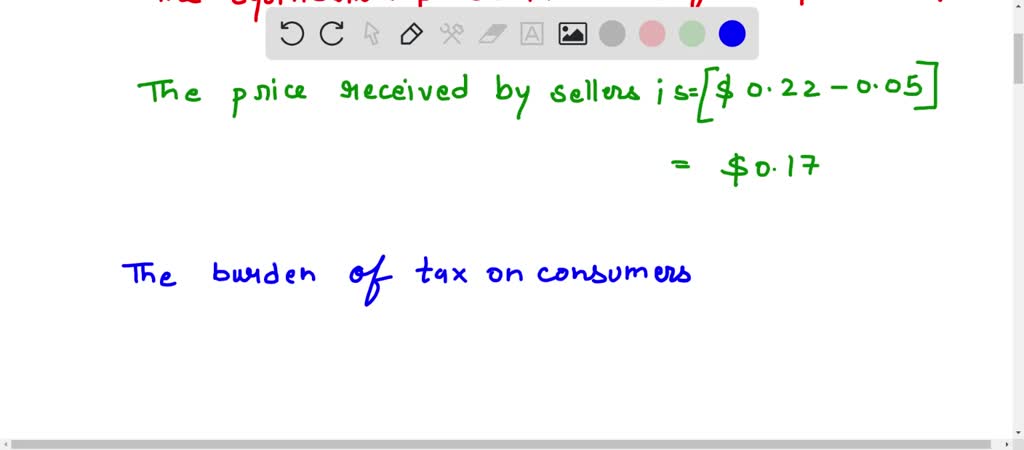

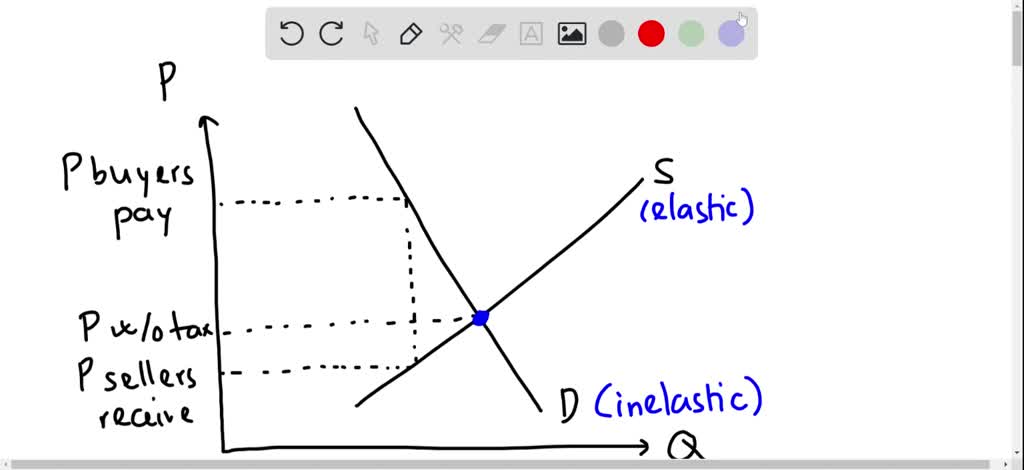

A tax levied on the buyers (demand side) of a product: A. Leads to a lower equilibrium B. Shifts the demand curve to the right C. Has no effect on the supply

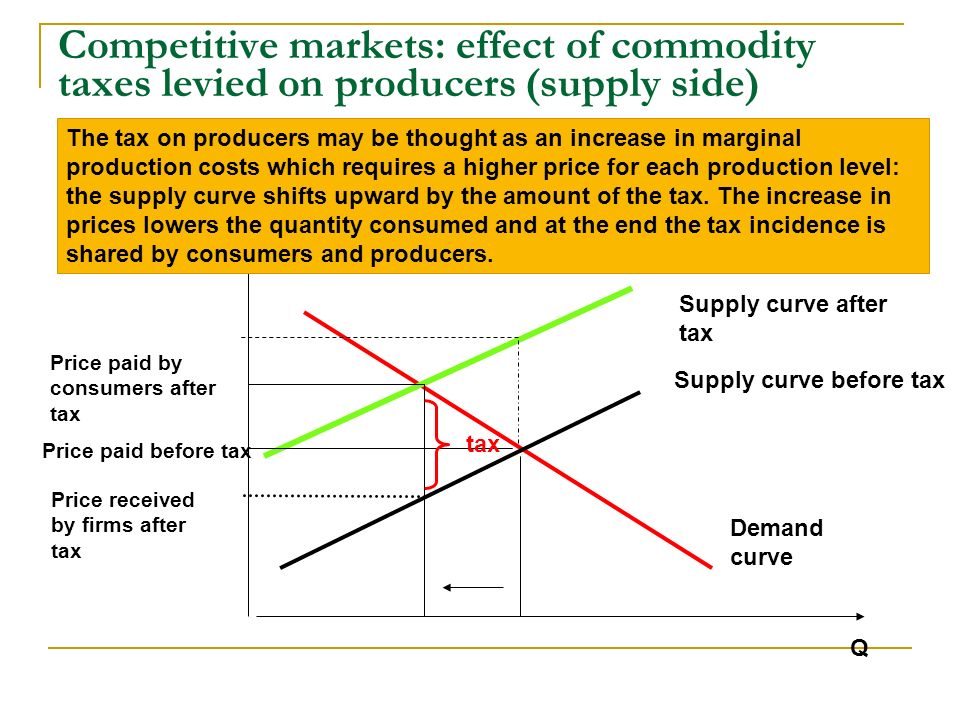

SOLVED: 3)Suppose a tax on beans of 0.05 per can is levied on firms. As a result of the tax, the equilibrium price increases from0.20 to 0.22. What fraction of the tax

1. Levy To forcibly place a tax The colonists became angry about all the taxes that the British levied on them. Causes of the American Revolution Vocabulary. - ppt download

SOLVED: When a good is taxed, the burden of the tax falls mainly on consumers if a. the tax is levied on consumers. b. the tax is levied on producers. c. supply

Frederick the Great Quote: “No government can exist without taxation. The money must necessarily be levied on the people; and the grand art consists...”

Excise Taxes Blue Concept Icon Legislated Taxation On Purchased Goods Idea Thin Line Illustration Tax Levied

ECON101 - Question#7 8.docx - Question#7 Consider the market below. a. Suppose there is a $1.50 per unit tax levied on sellers. Draw the after-tax supply | Course Hero

:max_bytes(150000):strip_icc()/taxes-4188113-1-fb27402db4ac4638875e56eefb0ba00d.jpg)

:max_bytes(150000):strip_icc()/GoodsandServicesTax-36b9fbf71b1048a8ad617e0318af9c6b.jpg)