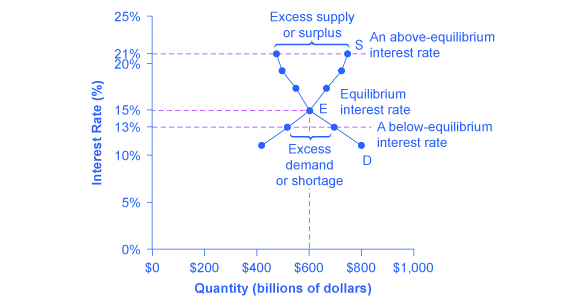

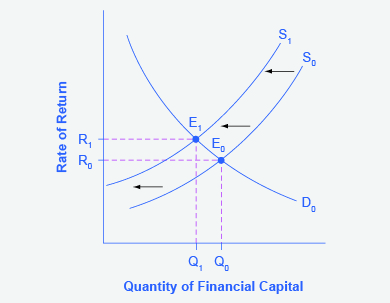

How is the equilibrium interest rate determined in an open economy with restricted capital flows? Draw a diagram showing your reasoning. | Homework.Study.com

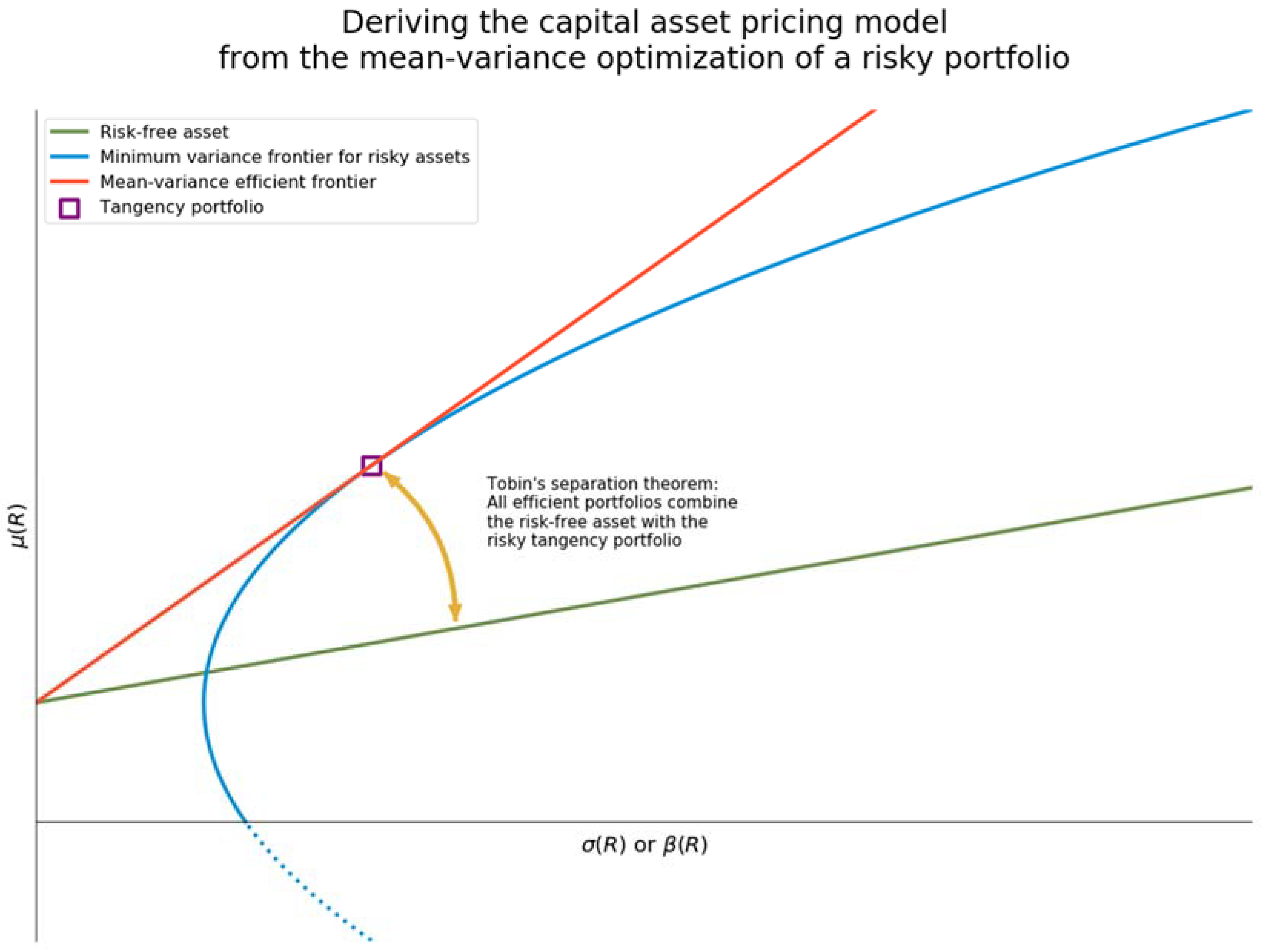

Higher cost of finance exacerbates a climate investment trap in developing economies | Nature Communications

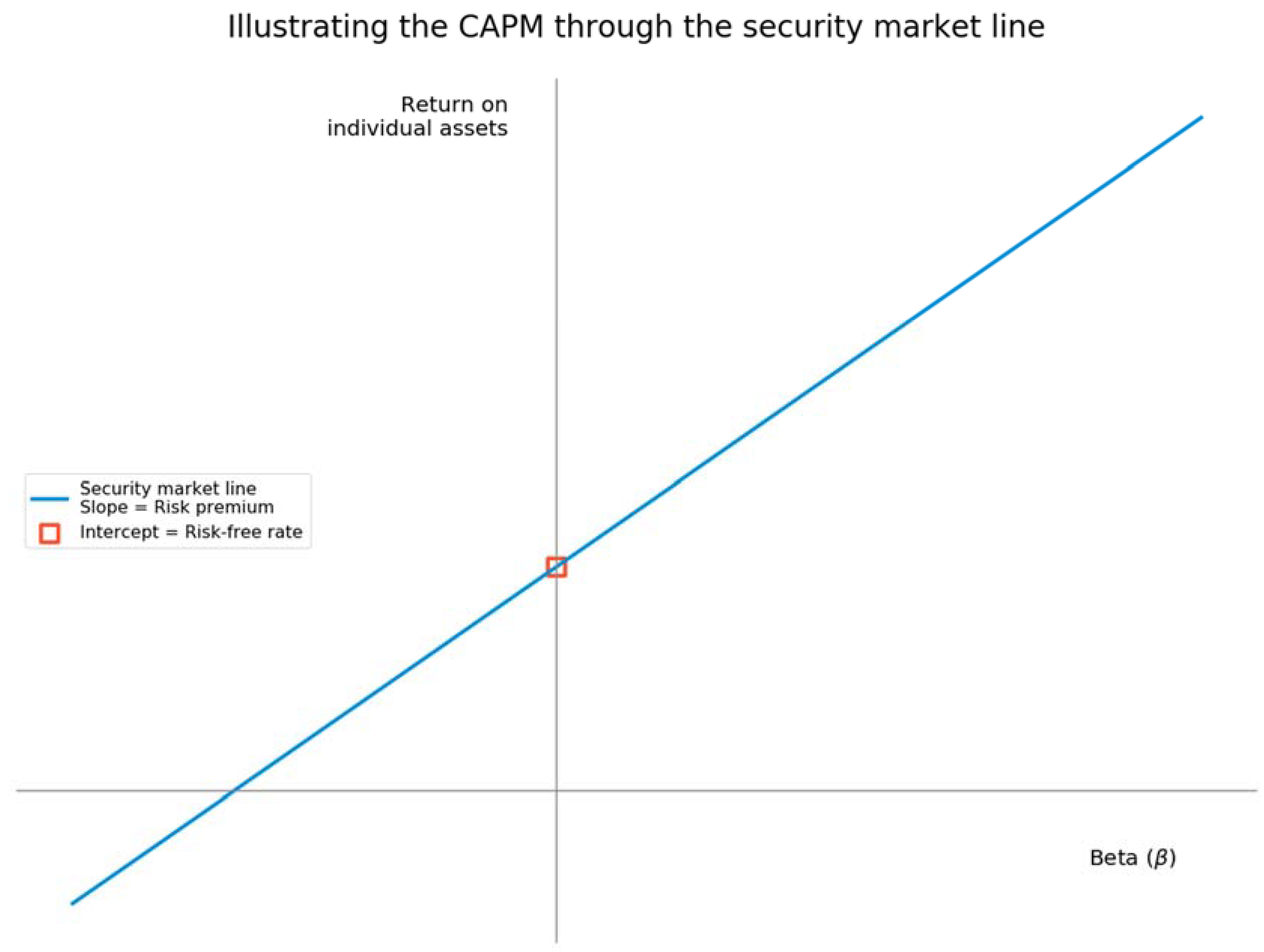

CAPITAL ASSET PRICES: A THEORY OF MARKET EQUILIBRIUM UNDER CONDITIONS OF RISK* - Sharpe - 1964 - The Journal of Finance - Wiley Online Library

Twitter \ david sraer على تويتر: "reg T margins are restrictions imposed by financial regulators on how much investors can borrow (both cash and stocks) when investing in equity markets. This graph

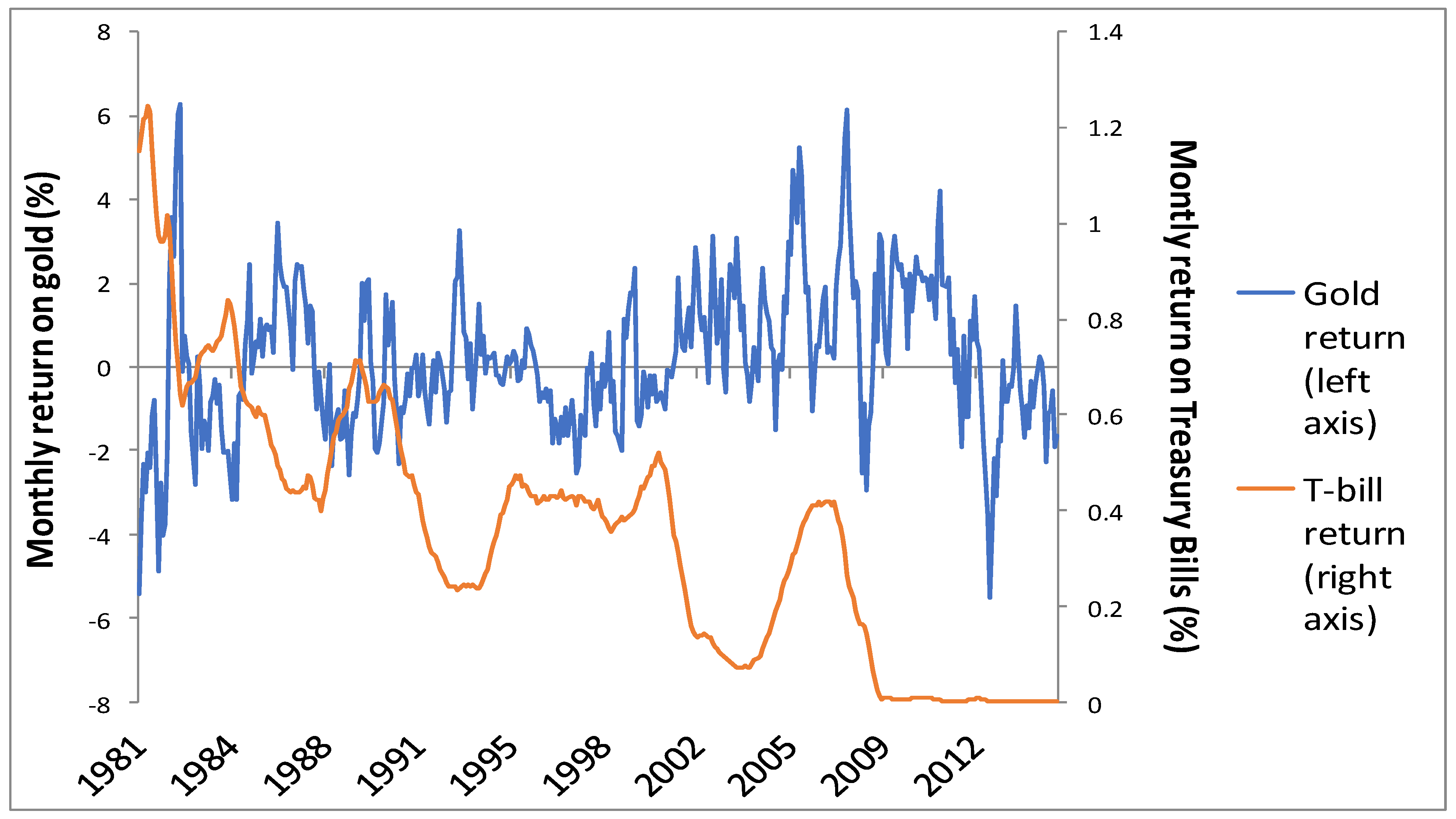

JRFM | Free Full-Text | Assessing the Use of Gold as a Zero-Beta Asset in Empirical Asset Pricing: Application to the US Equity Market

Black&fisher - read and learn the correct research writing skills - Capital Market Equilibrium with - Studocu

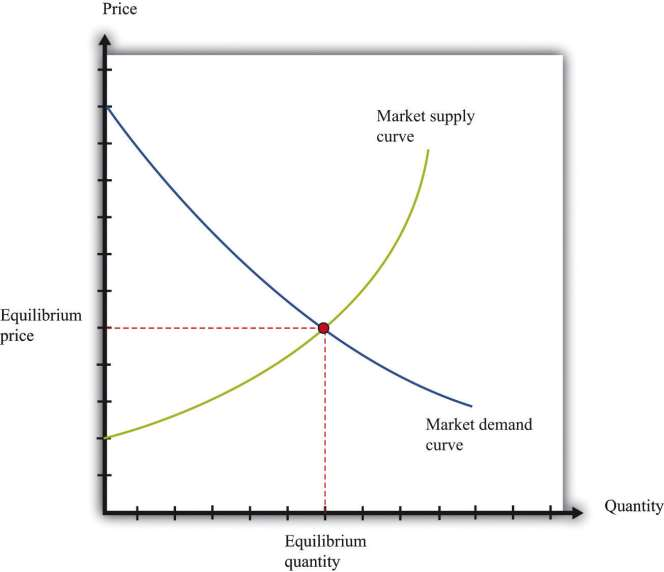

5.2 Demand and Supply in Financial Markets – Principles of Microeconomics: Scarcity and Social Provisioning